Loan borrowing capacity

Ad Fill in One Simple Form Get The Best Personal Loan Offers for You. Borrowing capacity and affordability may seem like they are interchangeable but they are not.

Understand The 5 C S Of Credit Before Applying For A Loan Forbes Advisor

Calculate Your Rate in 2 Mins Online.

. This calculator will help you estimate your home loan borrowing capacity the value of the home you can afford assuming you are buying with a 20 deposit and your monthly repayment. Skip the Bank Save. Borrowing capacity is defined by the amount you can obtain from your bank to finance the purchase of your future home.

If you wish to apply for a loan please call us on 1800 100 258. The Bank of Spain advises that the maximum amount that a. It indicates how much money you can safely afford to borrow without defaulting on your repayments.

Get an Online Quote in Minutes. For a conventional loan your DTI ration cannot exceed 36. Click Now Apply Online.

The amount a lender is willing to let you borrow for a home loan is your borrowing capacity. Examine the interest rates. Therefore you have to relate your personal revenue and your.

Different lenders require different lending criteria. Borrowing capacity or creditworthiness is the maximum amount that a company or individual can borrow without jeopardising their financial solvency. Get an estimate in 2 minutes.

International Customers can call 675 305 7842. Marathon Doubles Loan Borrowing Capacity to 200M as Mining Rigs Sit Idle. The ING Borrowing Power Indication is not an offer of credit.

For example if you have a 5000 credit card limit and you owe 1000 on that card the math for calculating your credit utilization will look like this. Standard borrowing capacity is between 30 and 40 of income which means that debt should never exceed 13 of the individuals remuneration. Term Loan Borrowing Capacity - a at any time prior to the Seventh Amendment Effective Date an amount equal to x the sum of i 1085 of the Appraised Inventory Liquidation Value of each Eligible Inventory Category.

Any application for credit is subject to INGs credit approval criteria. Estimate how much you can borrow for your home loan using our borrowing power calculator. Your expenses include all your daily living costs and regular financial commitments like bills groceries and petrol as well as any other debts you.

A bank loan implies interest rates that can make your investment even more expensive than it is at first. Multiply your number by 100 to see your credit utilization as a percentage. Choose From Multiple Student Loan Repayment Options Loan Terms To Fit Your Budget.

To calculate your borrowing power we take into account a couple of key pieces of information your income and your debts. Borrowing capacity is calculated by lenders based on their assessment rate allowing them to assess whether your current financial circumstances will allow you to service your mortgage over the specified loan period. If you need any assistance with this Id be happy to run some high level figures just to help anyone out Thanks for offering your help.

Ad We Picked the 10 Best Personal Loan Companies of 2022 for You. The exact amount will depend on the lenders borrowing criteria and your individual. High-Quality Reliable Legal Solutions Developed by Lawyers.

The borrowing calculator is built using a. To gain an understanding of how much you can afford to borrow you can use the personal loan calculator to estimate your borrowing power. For information on how these results are calculated details are listed on our borrowing power calculator assumptions page.

Marathon Digital Holdings MARA refinanced an existing 100 million line of credit from Silvergate Bank SI and added. Increase your borrowing power by reducing the number of additional features on your home loan extending your loan term and improving your credit score. How Lenders Calculate Your Borrowing CapacityClip from Episode 051 - Aaron Whybrow shares how different lenders calculate your borrowing power and the variab.

The new term loan includes a delayed draw facility meaning Marathon can draw 50 million at the time of closing and. To estimate your borrowing capacity you should enter the number of borrowers ie. Well Help You Get Started Today.

Get Pre-Qualified in Seconds. Ad Our Student Loans Cover Up To 100 Of College Costs From Tuition Housing Books More. Define Term Loan Borrowing Capacity.

Ad Create a Custom Loan Contract to Ensure Payment Within a Specified Time Period. It depends on several different factors including income assets liabilities debts credit history. It is a main component to determine the type of property that you can acquire.

My partner and I have a combined income of approx 210k. View your borrowing capacity and estimated home loan repayments. The borrowing capacity also called debt capacity is the maximum capacity that a company has to borrow from the bank and thus endanger its budget balance.

Borrowing power or borrowing capacity refers to the estimated amount that you may be able to borrow for a home loan calculated generally as your net income income after tax minus your expenses. Get Instantly Matched with the Best Personal Loan Option for You. If you wish to apply for a loan please call us on 1800 100 258.

1000 5000 02 x 100 20. Calculate how much you can borrow to buy a new home. Your total minimum monthly debt is divided by your gross monthly income to express your Debt-to-Income ration DTI.

Ad Were Americas 1 Online Lender. Your borrowing power is the amount of money which you can borrow and pay back to a lender. You can use Canstars Home Loan Borrowing Power Calculator to estimate your borrowing power.

Moreover the greater your deposit the more money you can borrow. Create on Any Device. By shopping around or approaching a mortgage broker you may find you improve your borrowing capacity.

Our calculator will assume a 20 down payment but there are plenty of financing options available some for as little as 3 down remember if you put less. Compare Low Interest Personal Loans Up to 50000. Typically borrowing power depends on your income deposit size living expenses credit score home loan type interest rate other assets and property priceLets take a closer look at each of these.

Thus as part of calculating your borrowing capacity it is also wise to ask your lender what is going to be the interest rate for your loan. Is hereby deleted in its entirety and the following text is substituted in its stead. Your debt-to-income ratio is a metric that your loan officer will use to help determine how much youll be able to qualify for or how much house you may be able to afford.

What is the borrowing capacity for a home loan. Whether you will be applying for the home loan by yourself or with someone. The information provided by this borrowing power calculator should be treated as a guide only and not be relied on as a true indication of a quote or pre-qualification for any home loan product.

Marathon Doubles Loan Borrowing Capacity to 200M as Mining Rigs Sit Idle. As you see a good borrowing capacity. With rates constantly changing every month some people might be really confused as to what their borrowing capacity is in this market.

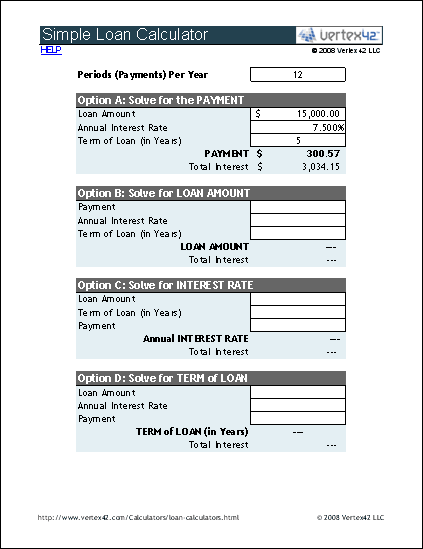

Simple Loan Calculator

Download Microsoft Excel Simple Loan Calculator Spreadsheet Xlsx Excel Basic Loan Amortization Schedule Template

Borrowing Capacity Explained Your Mortgage

Loan Calculator That Creates Date Accurate Payment Schedules

Downloadable Free Mortgage Calculator Tool

Loan Calculator That Creates Date Accurate Payment Schedules

Measuring Repayment Capacity And Farm Growth Potential Farmdoc Daily

Loan Dashboard For Banks Example Uses

Lvr Borrowing Capacity Calculator Interest Co Nz

Loan Repayment Calculator

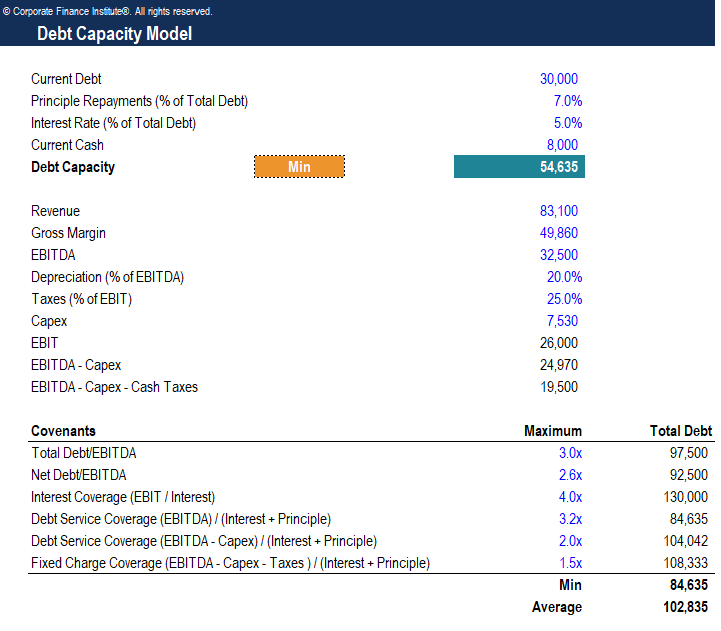

Debt Capacity Metrics Ratios To Assess A Company S Debt Capacity

The 5 C S Of Credit What Lenders Look For

Advanced Loan Calculator

Debt Capacity Metrics Ratios To Assess A Company S Debt Capacity

Debt Capacity Model Template Download Free Excel Template

What Is Asset Based Lending Who Qualifies

Loan Calculator Free Simple Loan Calculator For Excel